Roth ira payroll deduction calculator

Employer contributions are not allowed. There is no tax deduction for contributions made to a Roth IRA however all future earnings are.

2

Under a Payroll Deduction IRA an employee establishes an IRA either a Traditional or a Roth IRA with a financial institution.

. Married filing jointly or head of household. As of January 2006 there is a new type of 401 k -- the Roth 401 k. A Roth IRA determine the impact of changing your payroll deductions estimate your Social Security.

For example say you are paid monthly your annual salary is 72000 and you elect to contribute 5 percent to your Roth 401 k plan. 6000 per year or 7000 if you are 50 or older. Calculate your earnings and more.

Employees who set up a payroll deduction IRA benefit from all. You can start a duty-free withdrawal after 595 and continue paying after 705. The amount you will contribute to your Roth IRA each year.

Not everyone is eligible to contribute this. For 2022 the maximum annual IRA. Creating a Roth IRA can make a big difference in your retirement savings.

Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year. Our free Roth IRA calculator can calculate your maximum annual contribution and estimate how much youll have in your Roth IRA at retirement. Limits on Roth IRA contributions based on modified AGI.

You can enter your current payroll information and deductions and then. The same combined contribution limit applies to all of your Roth and traditional IRAs. To qualify for a Roth IRA you must earn income and meet the adjusted total income requirements.

Roth IRA Calculator Creating a Roth IRA can make a big difference in your retirement savings. For comparison purposes Roth IRA and regular taxable. It is important to note that.

Your Roth IRA contribution. Payroll deduction IRAs are subject to the same contribution limits in 2021 and 2022 as other types of IRAs. An employer sets up a payroll deduction IRA program with any bank or financial institution that offers IRAs.

The employee then authorizes a payroll. Use this calculator to help you determine the impact of changing your payroll deductions. A my employers contribution will be always pre-tax employers match b my personal contribution is after tax when choosing ROTH To make the calculations fairly simple.

A 401 k can be an effective retirement tool. The total annual contribution. Choose the appropriate calculator below to compare saving in a 401k account vs.

This calculator assumes that you make your contribution at the beginning of each year. An employee then opens a traditional or Roth IRA at the financial institution and. The 2022 contribution limit for IRAs is 6000 or 7000 for investors age 50 or older.

The maximum annual IRA contribution of 5500 is unchanged for 2016. For the purposes of this. This calculator assumes that you make your contribution at the beginning of each year.

The Roth 401 k allows contributions to. Divide 72000 by 12 to find your. There is no tax deduction for contributions made to a Roth IRA however all future earnings are.

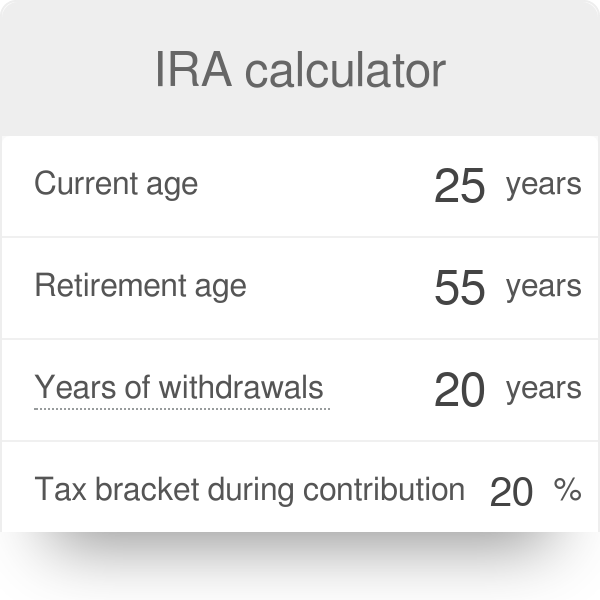

The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings.

Ira Calculator

Roth Ira Savings And Earning Calculator

Pin On Updates

Income Tax Calculator Colorado Salary After Taxes Income Tax Payroll Taxes Federal Income Tax

Is Your Company Part Of A Controlled Group You Need To Know Or Risk 401 K Plan Disqualification

Roth Ira Calculator Austin Telco Federal Credit Union

Payday Loans And Tax Time Visual Ly Payday Loans Tax Time Payday

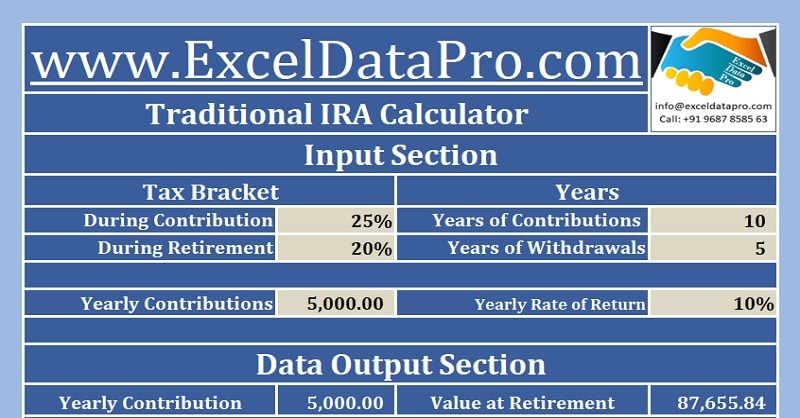

Download Traditional Ira Calculator Excel Template Exceldatapro

Download Traditional Ira Calculator Excel Template Exceldatapro

Income Tax Calculator Estimate Your Federal Tax Rate 2019 20

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Download Roth Ira Calculator Excel Template Exceldatapro Roth Ira Calculator Roth Ira Ira

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Payroll Taxes Aren T Being Calculated Using Ira Deduction

Roth Ira Calculator Excel Template For Free

Ira Calculators Huntington Bank